“Political and public scrutiny over pricing of both new and old drugs is not going to go away,” EvaluatePharma called out in its report.

The intense scrutiny on pharma industry pricing was fostered by Martin Shkreli in his pricing of Daraprim (taking a $13.50 product raising the price to $750), Harvoni and Sovaldi pricing for Hepatitis C therapies, and last year’s EpiPen pricing uproar.

A May 2017 analysis of prescription drug costs by AARP judges that, “Nothing stops drug companies from charging the highest price the market will bear.”

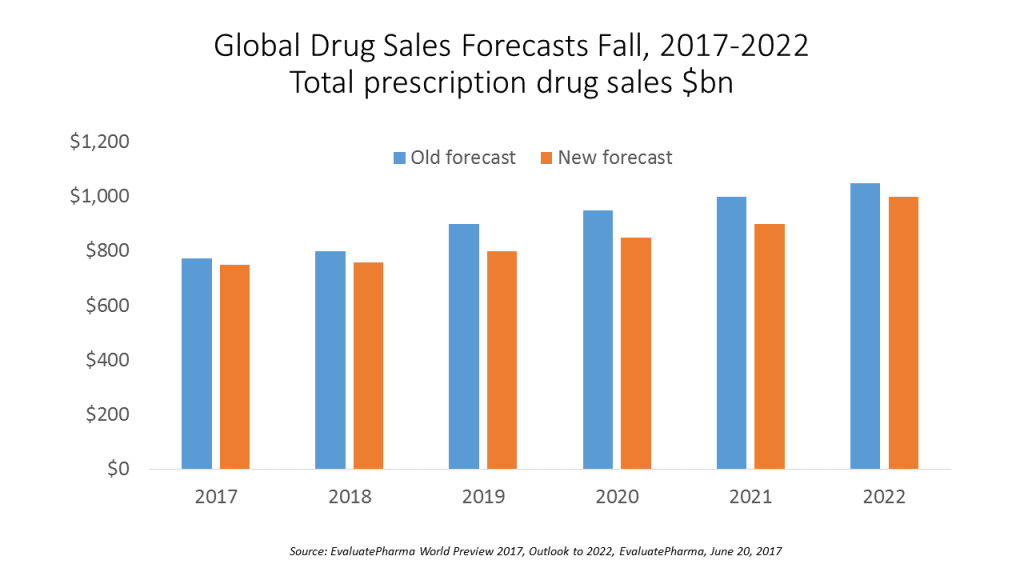

Projecting a compound annual growth rate of 6.5% between 2017 and 2022, EvaluatePharma identifies the following drivers and brakes on drug sales over the next five years:

Drivers fostering Rx revenues include:

- Additional sales from Orphan drugs, accounting for 32% of total growth

- 27 new FDA approvals in 2016, with the pace picking up in 2017

- $522 mm average value of new approvals in 2016, above 2010-2015 averages

- A 13% compound annual growth rate for oncology therapies to reach $192 bn in 2022.

The brakes on worldwide prescription drug sales grow are expected to be:

- $194 bn sales at-risk due to patent expirations between 2016-22

- 54% sales erosion due to biosimilars expected for top-selling biologic therapies

- $4 bn average R&D spend per new molecular entity (NME) since 2006, increasing pressure of pharmaceutical companies’ productivity.

“Although Donald Trump has yet to directly intervene on US drug costs, the threat remains ever present and some pharma companies have announced their own pre-emptive strikes, by publicly announcing caps to price hikes,” the report asserts.

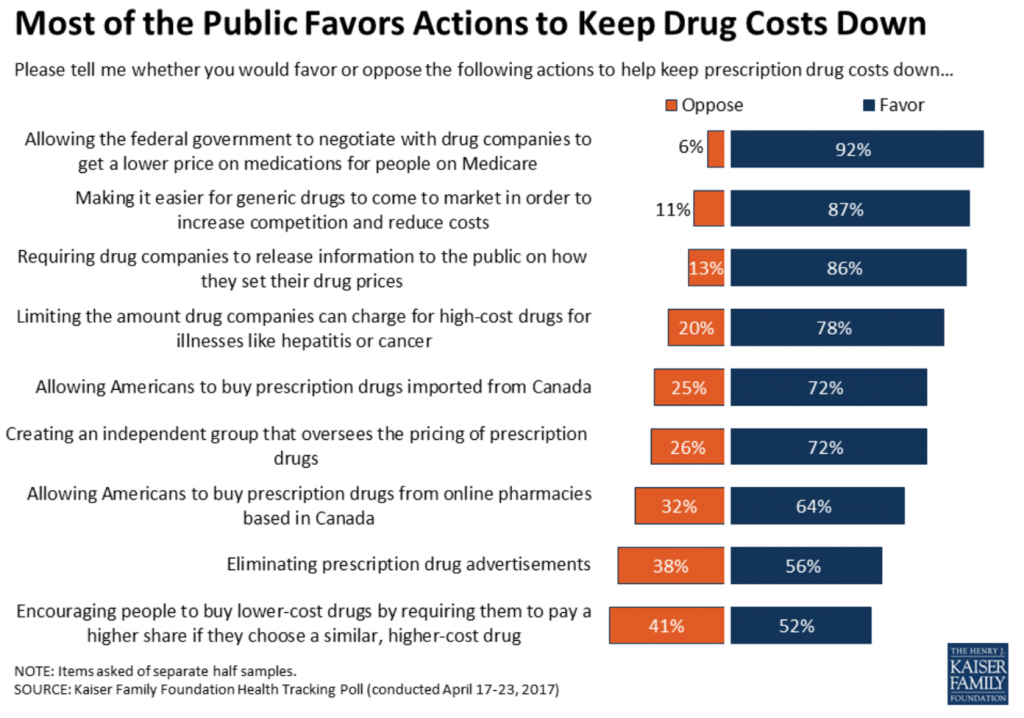

Notwithstanding some (not all) pharma companies’ efforts to rationalize or moderate prescription drug pricing, American voters are fully supportive of the Federal government allowing Medicare to negotiate lower prices for medications, shown in the Kaiser Health Tracking Poll from April 2017.

The issue of drug pricing is, for most Americans, part of a larger discussion on health care reform that is not being addressed through the AHCA discussions or as aggressively by the White House as President Trump had committed during his campaign. Remember Candidate Trump’s pronouncement — “I’m going to bring down drug prices,” Mr. Trump said, quoted on the TIME website naming him Person of the Year. “I don’t like what’s happened with drug prices.”

The President has, for now, decided on a strategy to ease regulatory drug approval hurdles in the FDA as a tactic to lower drug prices, discussed in the New York Times here. This could be akin to an expectation of trickle-down price reductions. But it may not produce as direct an impact on consumer-facing drug prices as voters — Democrats, Independents, and Republicans alike — desire.

The post Global Drug Sales Forecasts Fall For Next Five Years appeared first on HealthPopuli.com.

Article source:Health Populi

No comments:

Post a Comment