That sober metric was calculated by Crowe Horwath, published in its benchmarking report published today with a title warning that, Self-Pay Becomes Ground Zero for Hospital Margins.

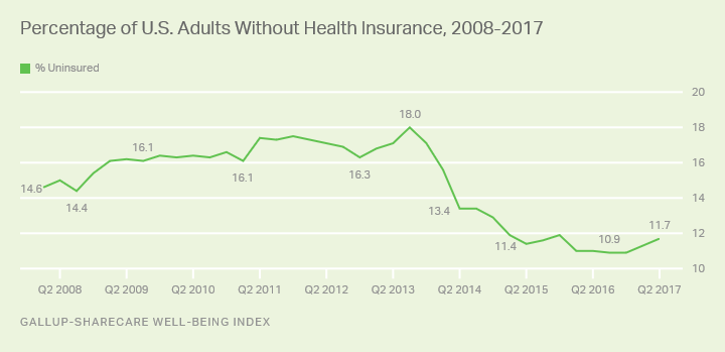

The “ground zero” for the average U.S. hospital is the convergence of a potential repeal of the Affordable Care Act (ACA), which could increase the number of uninsured Americans by 22 million in the latest CBO scoring of the Senate’s health reform bill; and, the growth of high-deductible health plans, which transfer greater medical financial risk burden (which translates into self-payment) onto patients.

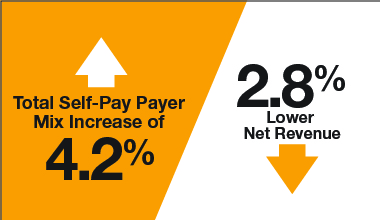

The simple math, Crowe Horwath calculates, is that for every 2% increase in self-pay in a hospital payer mix due to an erosion in Medicaid, hospitals’ net revenues would decline by 1%.

For its benchmarking methodology, Crowe Horwath analyzed data from over 850 individual hospitals serving acute, critical-access, rehabilitation, psychiatric and cardiovascular care markets in the U.S.

Even without an ACA repeal, the shaky health insurance market facing American health citizens, whether un- or under-insured, or more fully insured at the workplace, has led to uncertainty among people facing greater out-of-pocket costs. Healthcare remains the top household financial pocketbook issue for Americans.

I must point out some good news on the financial wellness front as it’s been a rare message here on Health Populi in recent postings. The good news, starting September 15, 2017, is that three of the largest credit agencies (Equifax, Experian, and TransUnion) will address medical spending separately from the overall consumer credit report for a six-month period. Furthermore, medical debt will be removed from a consumer’s credit report once it is paid by a health insurer. More on this can be read here in Kaiser Health News.

Forty-three million Americans have medical debt in collections that has adversely impacted their credit ratings, according to the federal Consumer Financial Protection Bureau. CFPB’s study learned that for 15 million consumers, that medical debt was the only problem with their credit report.

The post Self-Pay Healthcare Up, Hospital Revenues Down appeared first on HealthPopuli.com.

Article source:Health Populi

No comments:

Post a Comment